Energy & Resources

Sector/Region: Resources/South Asia/Afghanistan

Griffin Capital was appointed by a privately held resource developer to evaluate, plan and implement responses to strategic opportunities in the Eurasian markets. In particular, we were tasked to advise and assist in winning pre-qualification approval from Ministry of Mines & Petroleum of Afghanistan for a proposed $300MM development project.

Griffin developed a risk mitigation strategy and arranged for the CEO to visit the Pentagon in Washington, DC where he presented to senior officials and mining experts at the US Secretary of Defense’s Task Force for Business and Stability Operations (TFBSO) and the US Geological Survey.

After five months of due diligence, undertaken by an international team of consultants in Washington, Paris, Dubai and Kabul, Griffin arranged a secure site inspection in Afghanistan for our client’s CEO and two lead directors as guests of the TFBSO. Following team meetings in Kabul, Frankfurt, Istanbul and Dubai, our client was short-listed for pre-qualification approval in early 2014. Amid allegations of fraud in Afghanistan’s April 2014 presidential election, the project was set aside. Project details: https://www.globalcement.com/magazine/articles/941-afghanistan-s-only-operational-plant-ghori-i

Sector/Region: Energy/EMEA

Acting on behalf of a UK institutional investor, Griffin Capital arranged acquisition finance for 6 industrial grid-connect PV generators in Germany of 13.7MW rated capacity.

Griffin raised c. €46MM of senior term facilities with KfW, several German banks and a leading mezzanine fund. These groups funded 85% of project cost at a fixed rate for 18 years. Due to the involvement of KfW, the interest rate on the senior debt was below market.

Griffin arranged Operations and Maintenance contracts for the monitoring and repair and maintenance of the parks that removed, to the greatest extent possible, the revenue volatility from breakdowns in production. Insurance covered the risk arising from breakages and damage to the equipment. Replacement and repair provisions were made for parts – the inverters – that suffered from wear and tear.

Today Griffin manages the generating companies on behalf of the owner. Though the equity investors were required to take the risk of volatility in weather and unforeseen breakdowns in the equipment, the equity IRRs have exceeded 11% after tax.

Sector/Region: Energy/EMEA/Kazakhstan, UAE

Griffin Capital was appointed by a Middle Eastern oilfield services engineering company as exclusive advisor to arrange funding to acquire the drilling fleet of a company operating in the Caspian Sea and Western Kazakhstan.

Griffin’s team relocated to Dubai for four months where we worked continuously with the CEO and his top managers and legal teams in Houston, London, New York, Dubai and Almaty, Kazakhstan. The Griffin team updated management’s valuation scenarios for use by lenders and equity participants in the acquisition; monitored fleet utilization and regional rig rates; arranged for an independent valuation of the drilling fleet; produced and distributed confidential Information Memoranda for debt and equity participants; initiated and led negotiations with a leading Russian bank and Middle Eastern mezzanine fund; supported our client’s negotiations with the seller’s lawyers and investment bankers; and finalized terms for $110MM senior and mezzanine facilities.

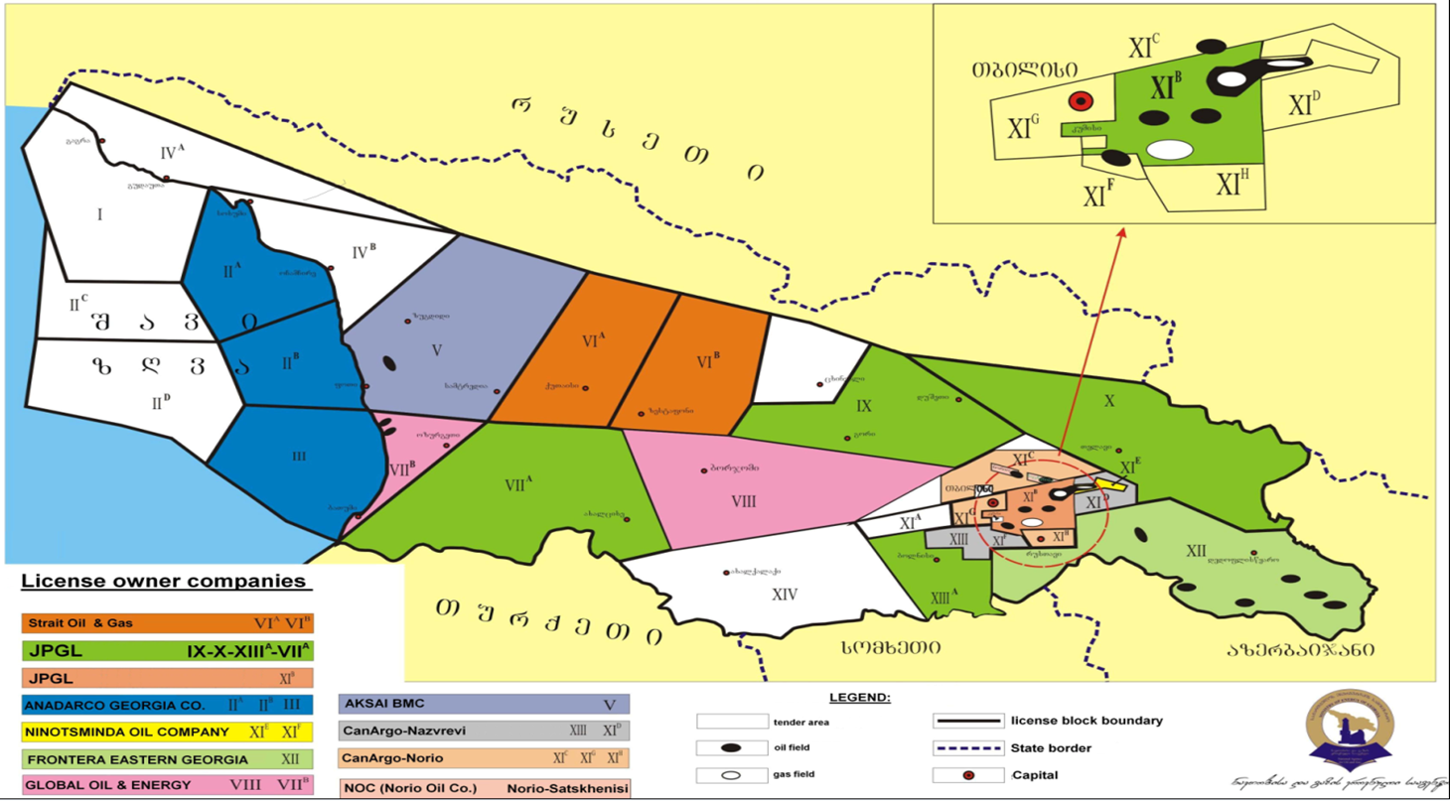

Sector/Region: Resources/EMEA/Georgia

Griffin Capital was appointed in 2015 by Jindal Steel & Power (India) to monetize its 100% holding in Jindal Petroleum Georgia Limited. JPG conducted oil and gas exploration in Georgia since 2009 on four license blocks – Vll a, lX, X, Xlll a – and production operations on block Xlb.

JPG’s five license blocks covered 16,168 sq km along both sides of the Baku-Tbilisi-Çeyhan Pipeline with access to Black Sea terminals.

The blocks were acquired by Schlumberger Rustaveli Company Limited who later drilled an exploratory well.

Sector/Region: Resources/Eurasia

Griffin Capital was retained to develop and implement capitalization strategies for a private equity backed Central Asian cement group. Griffin’s broad mandate included refinancing, or sale, of existing and to-be-upgraded plants and affiliates operating within and between Russia, Kazakhstan, Kyrgyzstan and Uzbekistan.

Working closely with the CEO and board of directors, we evaluated financial and operating results of 8 business units and associated plants in all four countries. Our team identified and made presentations to strategic partners, funds and international lenders and development banks in Europe, North America, China and Japan. We undertook negotiations with several of the world’s leading cement groups seeking to expand into Central Asia and advised and assisted the CEO and directors during discussions with their leading stakeholders.

Sector/Region: Resources/EMEA/Turkey

Arda Mühendislik San. Ve Tic. Ltd (www.ardagrup.com) is among Turkey’s leading closely held global engineering and construction services companies. In 2017, Arda appointed Griffin Capital as exclusive project finance advisor for the first stage of a 70MWe geothermal power project within the Aydin-Germencik-Omerbeyli field, part of the Büyük Menderes Graben in Aydın province. That year, Turkey experienced dramatic developments which had an adverse impact on its ability to attract and sustain long-term USD FDI.

Explore Further

Aerospace

Satellites, near-space remote sensing and UAVs and UASs

Energy & Resources

EOR, CCS, Oil and gas, solar, wind, geothermal power generation and mining in Europe, Turkey, Georgia, trans-Caucasus and Caspian regions, Russia, Central Asia, Kazakhstan, Kyrgyzstan, Afghanistan and Uzbekistan, Казахстан, Кыргызстан, Россия, Узбекистан

Logistics & Markets

Ports, railroads, LBS (Location Based Services) and digital markets …

Property

Finance and securitization of commercial, residential and institutional property worldwide.

TMT

Technology, Media and Telecommunications (FONs and mobile)